Plenti Lending Platform: June 2025 quarterly data report

Shareholders in Plenti should be aware that the data provided in this report only relates to the PLP and does not provide a complete picture of Plenti's total loan portfolio. Shareholders should refer to Plenti's ASX releases for data in relation to the performance of the entire Plenti loan portfolio.

| PLP lending statistics at 30 June 2025 | |

| Total amount lent1 | $1,266,636,244 |

| PLP loan book | $126,897,454 |

| Total Interest paid earned | $115,966,630 |

| Number of loans outstanding | 11,999 |

| Average outstanding loan amount | $10,576 |

| Weighted average remaining term | 38 months |

1 Lending statistics since inception

An important feature of the PLP is the Provision Fund. The Provision Fund comprises cash held on trust for the benefit of members who invest via the PLP and is designed to help protect them from loss in the event a borrower misses a payment or defaults. Information on the Provision Fund position at 30 June 2025 is set out below.

| Provision Fund and expected loss data at 30 June 2025 | |

| Cash in Provision Fund1 | $7,847,811 |

| Expected Provision Fund inflows2 | $705,523 |

| Provision Fund total3 | $8,553,334 |

| Provision Fund total as % of loan book | 6.7% |

| Claims made on Provision Fund to date | 100% |

| Claims paid by Provision Fund to date | 100% |

1 Funds currently held as cash at bank

2 Expected Provision Fund inflows represents contracted PLP borrower contributions to the Provision Fund due over the lifetime of outstanding PLP loans, adjusted to reflect expected early repayments and bad debt

3 Provision Fund buffer is the sum of money in the Provision Fund and expected future Provision Fund inflows

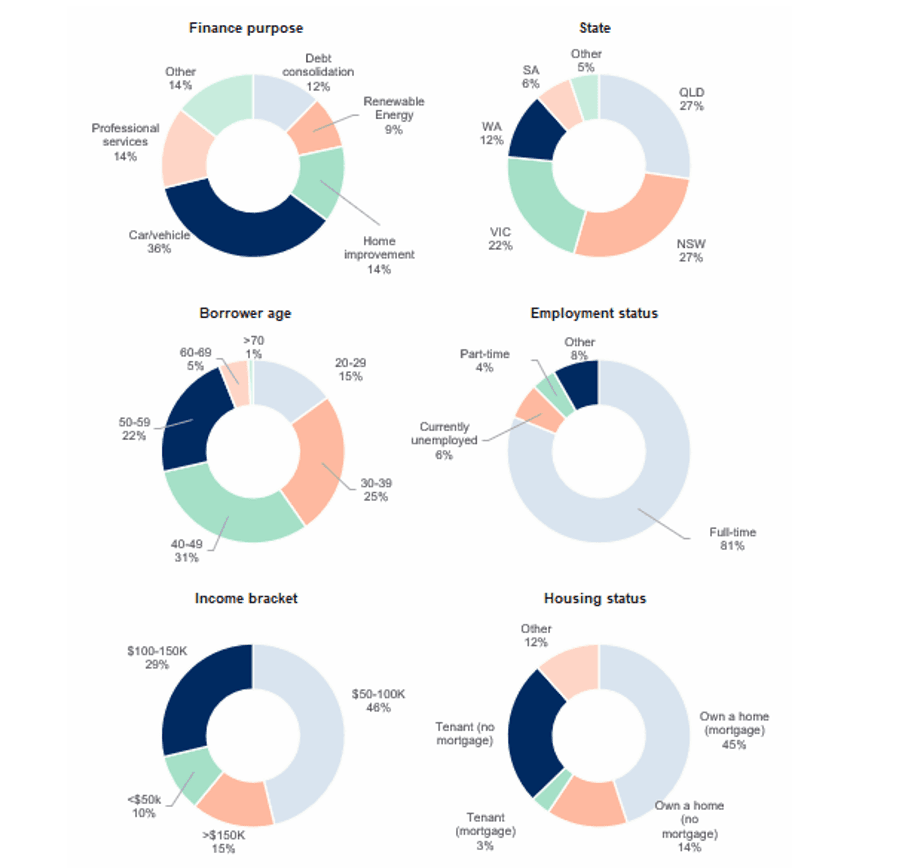

PLP loan and borrower characteristics at 30 June 2025 (based on principal outstanding)

The information contained in this blog is accurate only at the date of publication. Expected losses and the performance of the Plenti Lending Platform loan book cannot be known with certainty and expectations are subject to change. Lender rates may assume your investment is protected by the Provision Fund in the event of any borrower late payment or default, however, there is no guarantee nor warranty as to any protection from the Provision Fund. Fees apply. Capital at risk. See the PDS and SPDS for details.

This information should not be taken as financial product advice and has been prepared as general information only without consideration of an individual’s particular investment objectives, financial circumstances or needs. Consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) available on our website to decide if this product is right for you.

All figures stated represent the Plenti Lending Platform (ARSN 169 500 449) only unless stated otherwise.

The availability of the Early Access Transfer Feature is at Plenti's discretion and is subject to the terms and conditions set out in the PDS.

Issued by Plenti RE Limited ABN 57 166 646 635 AFSL 449176. Capital at risk. Past performance is not a reliable indicator of future performance.