Plenti prices PL & Green ABS, taking 2024 issuance to over $1.1 billion

Plenti Group Limited (Plenti) announces the pricing of a $330 million asset-backed securities (ABS) transaction backed by personal and renewable energy receivables (the Plenti PL & Green ABS 2024-2). This is Plenti's third ABS transaction for 2024, taking total issuance for the year to $1.16 billion

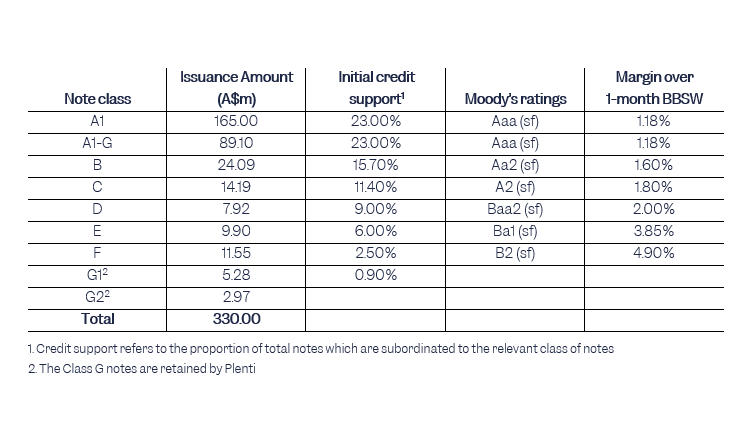

The ABS structure was rated by Moody's, with the strength of the credit performance and credit profile of the underlying borrowers reflected in the credit support required for each tranche.

The strong pricing outcomes achieved saw the weighted average margin on notes issued at 1.44%, down from 1.87% on the PL & Green 2024-1 ABS executed in February this year.

ABS transaction structure

Commenting on the transaction, Miles Drury, Plenti's Chief Financial Officer, said:

“We are delighted to have completed this $330 million renewable energy and personal loan ABS transaction, the third transaction this year and our eighth overall, which takes Plenti's total ABS issuance to over $2.8 billion.

“The transaction priced at very attractive margins relative to comparable ABS transactions, reflecting strong support from Plenti relationship investors, significant new investor interest and healthy debt capital market conditions.

“We are delighted to be introducing new investors to our ABS program and thank existing investors for their ongoing support.”

The transaction is expected to settle on or around 1 November 2024, subject to satisfaction of customary conditions precedent.

National Australia Bank acted as arranger and National Australia Bank, Westpac Banking Corporation and Standard Chartered Bank acted as joint-lead managers.

This release was approved by Plenti's Chief Executive Officer.